Crypto. The view of a bear

Posted

I’ve been vaguely following Bitcoin and the crypto space since it first entered the public realm eight or nine years ago. I’ve never invested and every now and then have the odd pang of feeling like I’m missing out. Watching the “Crypto.com Miami Grand Prix” this past weekend only served to remind me how mainstream this is all becoming.

Yet, every time I think about the market I’m struck by how speculative it is and the enormous environmental impact.

The crypto space is not a homogenous whole. Like any big innovation there are hucksters and scams, but also some compelling new thinking. Think of early uses of electricity which included all sorts of quackery such as the electric bath. What’s real and what’s hype?

Start with Non Fungible Tokens (NFTs). There’s a core of an idea here: record and unambiguously demonstrate ownership of something in a way that cannot be erased or later changed by writing that ownership to a blockchain. That’s often the purview of government (think land registries), so it’s interesting to see a distributed alternative to that. Indeed way back in 2017 the government of Georgia, experimented with this. Fundamentally, however, property rights only work if a justice system is willing to recognize & enforce them. What real incentive does a government have to cede control of the centralized ledger that it has duty to enforce?

The loudest use of NFTs right now is to secure title to a URL. What’s on the other end of this URL is supposed to be art. However, if you don’t control the domain, you don’t really control the artwork as Moxie Marlinspike demonstrated early this year: since a hash of the artwork isn’t stored on the blockchain, there is nothing to stop the thing on the end of the URL being changed or disappearing.

Add to that the almost daily ‘rug-pulls’ taking advantage of those who fear missing out and we have a classic gold rush which, history suggests, only ends one way.

Worse, as Marlinspike writes, most people’s wallets aren’t running on devices they control. That’s not surprising: it’s complex to get setup and people lack the skills. Instead, they’re using wallets hosted by companies like Crypto.com or PayPal. For those who believe in the decentralization, anonymity, or tax avoidance of crypto, there are a couple of problems here fundamentally rooted in the centralization of a set of wallets to gatekeeping companies.

- How much do you trust the company hosting the wallet for you? What happens if they disappear or get hacked?

- If you choose a company that hosts in the US they will have to (eventually) respond to subpoena (there goes your promise of anonymity) from the authorities

- They may well send a 1099-NEC or similar to the IRS

NFTs are implemented on smart contracts: pieces of code that execute in blockchains like Ethereum on given conditions. This is a piece of the crypto universe I can get behind: a fundamentally different programing model that does have great opportunity to change how we transparently solve transactions between parties that don’t fully trust each other. Better still, projects like Hyperledger give cooperating counterparties the ability to build their own blockchains, distributed across the parties to support their use cases. Just be sure the contract is implemented without infinite loops!

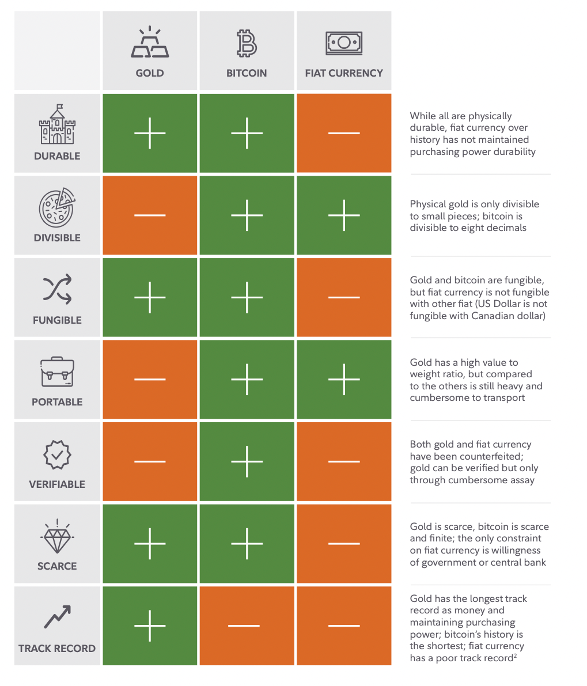

What about the grandaddy, Bitcoin? Fidelity make a good case that Bitcoin is different to others due to network effects, demonstrable scarcity, longevity, and decentralization. In this way, the argument is that it should be thought of as a store of value, a monetary good like gold. I found this chart helpful in the comparison:

If the weakness is track record, then the longer Bitcoin survives the less likely it is to fail (the Lindy Effect that Fidelity point out). However, I feel this chart does overstate things:

- gold (and other precious metals) can be held, in person and are not dependent on the Internet and energy to exist

- precious metals have intrinsic value (for example as jewelry). Bitcoin (and fiat currency) does not.

My fundamental issue with Bitcoin is by design: the process trades energy for security, requiring miners to invest increasing amounts in hardware and electricity to successfully mine, at this point, using more power than Sweden. Were that electricity all from renewable sources we would only have the problem of e-waste from discarded mining hardware. It seems highly unlikely that every miner is only using renewable.

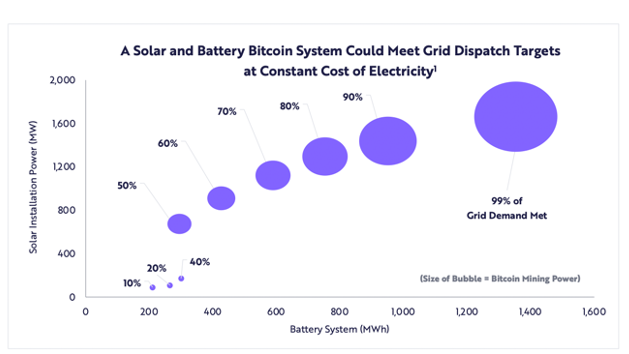

Bitcoin supporters argue that mining could revolutionize energy production: by driving demand they create incentive for suppliers to produce more electricity and do their own mining to capture surplus renewable power:

Maybe? There’s a lot of hope and aspiration there, and we have enough energy problems already.

Ultimately, I believe there are some powerful ideas and computer science here. The use of blockchains amongst co-operating competitors and industry groups can solve real problems in new, transparent ways. Bitcoin and NFTs? I’m not sold. As El Salvador is finding, large nation states and transnational organizations like the IMF have strong incentives to keep with the status quo. Beyond that, the energy utilization is a deal breaker for me.

What do you think?